Statutory & Other Audits

Introduction

Tax audit is the verification of the books of accounts of an assessee to validate the income tax computation and compliance with the laws of Income Tax. Auditing of books of accounts must be carried out by a certified Chartered Accountant.

The provisions relating to tax audit are provided under Section 44AD of the Income Tax Act. According to Section 44AB, tax audit is required for the following persons:

Business

In case of a business, tax audit would be required if the total sales turnover or gross receipts in the business exceeds Rs.1 crore in any previous year or as revised time to time under budget. Under the Income Tax Act, “Business” simply means any economic activity carried on for earning profits. Section 2(3) has defined the business as “any trade, commerce, manufacturing activity or any adventure or concern in the nature of trade, commerce and manufacture”.

Profession

In case of a profession or professional, tax audit would be required if gross receipts in the profession exceeds Rs.50 lakhs in any of the previous year or as revised time to time under budget. A profession or professional could be any of the following as per Rule 6F of the Income Tax Rules, 1962:

- Architect

- Accountant

- Authorised representative

- Engineer

- Film Artist – Actor, Cameraman, Director, Music Director, Editor, etc.

- Interior Decorator

- Legal Professional – Advocate or Lawyer

- Medical Professional – Doctor, Physiotherapist, etc.,

- Technical Consultant

Presumptive Taxation Scheme

If a person is enrolled under the presumptive taxation scheme under section 44AD and total sales or turnover is more than Rs. 2 crores, or as revised time to time under budget then tax audit would be required.

Also, any person enrolled under the presumptive taxation scheme who claims that the profits of the business are lower than the profits calculated in accordance with the presumptive taxation scheme would be required to obtain a tax audit report.

Due Date for Filing Tax Audit Report

The due date for completing and filing tax audit report under section 44AB of Income Tax Act is 30th September of the assessment year or as revised time to time under budget. Hence, if a taxpayer is required to obtain tax audit, then he or she would be required to file income tax return on or before 30th September along with the tax audit report.

Introduction

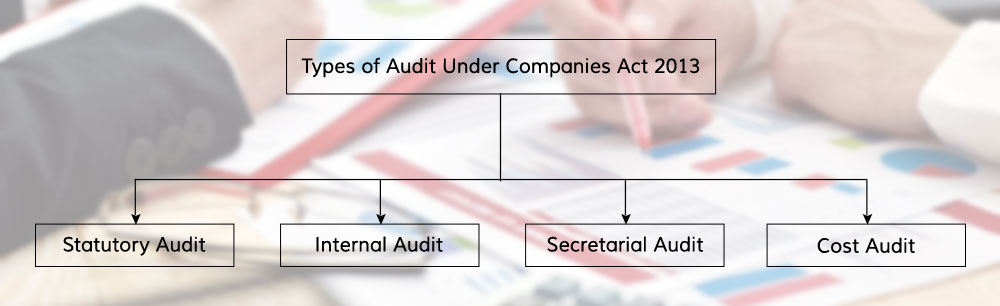

Statutory Audit Sections 139 to 147

Under chapter X of the Act contain provisions regarding audit and auditors. Section 139 contains that at the first annual general meeting every company shall appoint an individual or firm as it auditor who will hold office from the conclusion of that meeting till the conclusion of the sixth annual general meeting. Section 141 contains that a person shall be eligible for appointment as an auditor of a company only if he is a chartered accountant and in case of a firm whereof majority of partners practising in India are qualified for appointment as aforesaid may be appointed by its firm name to be auditor of a company. Section 143 which contains provisions regarding powers and duties of auditors contains that the statutory auditor shall make a report to the members of the company on the accounts and financial statements examined by him. The main provisions regarding statutory audit are:

Auditor will have access to books of accounts and vouchers etc. at all times and he can seek information from officers of the company as he may deem necessary. ·

In his report he must state, besides other things, whether the financial statements represent a true and fair view of the state of company’s affairs as at the end of the financial year. ·

In case of any qualifications in the audit report, the reason for same must be stated in the report. ·

In case auditor suspects any fraud, he must immediately report the same to the Central Government.

Internal Audit

Section 138 of the Bill contains provisions regarding internal audit. The provisions prescribed in the bill are very brief in nature which will be substantiated by the rules to be prescribed. The provisions contained in the bill are as follows:

- Certain class or classes of company as may be prescribed shall appoint an internal auditor who will conduct an audit of the functions and activities of the company and make a report thereon to the Board of Directors.

- Any chartered Accountant (except statutory auditor of the company) or Cost Account or other professional as may be decided by the Board, can be appointed to conduct the internal audit. ·

Secretarial Audit

Secretarial Audit is a new requirement which has been prescribed under Section 204 of the Bill. The provisions regarding secretarial audit are as follows:

- Every listed company and other class of companies as may be prescribed is required to annex to the Board’s Report, a Secretarial Audit Report.

- Secretarial Audit has to be conducted by a Practising Company Secretary in respect of the secretarial and other records of the company

- Company is required to give all necessary information and assistance to the Practising Company Secretary to conduct the audit.

- The Board is required to provide explanation in the Board’s Report to every qualification, observation or other adverse remark made by the company secretary in his report.

- As per Section 143(14), all provisions regarding rights, duties and obligations of statutory auditors shall also apply to Company Secretary in Practice conducting secretarial audit.

Cost Audit

Section 148 of the Bill contains provisions regarding cost audit and contains that a cost audit wherever conducted is in addition to statutory audit conducted under section 143.

Stock audit is becoming more important as businesses is becoming multi-location and vendors, dealers, partners becoming a key to the business process. Assets like stock, physical equipments and machinery and even people are located in any of the above premises and a good control mechanism is the need for the smooth running of the business.

Key benefits of Stock Audits :

- Identification : Identification of slow moving stock, obsolete stock, dead stock and scrap.

- Avoidance : Avoidance of pilferage and fraud

- Information : Instant information of value of inventory

- Cost Reduction : Cost reduction and bottom-line

- Reduction : Reduction in gaps in present inventory management process

Concurrent Audit is an audit which is conducted on concurrent basis, means no specific time period of Audit is defined particularly. In more simpler terms, usually a statutory or internal audit is conducted for a specified period say 1 year or 3 months. But, in concurrent audit no such Audit period is defined. It is conducted to check the daily transactions and ensure whether organisation is ensuring operational, regulatory compliance.

Usually concurrent audit is conducted for bank branches, depending upon the quantum of advances given. It also depends upon bank to bank and their risk taking capability. Concurrent audit is conducted to monitor day to day bank operations so that all the compliances and security measures are being followed. Concurrent audit involves daily account opening checking, cash balance, income leakage, NPA tracking, laws compliance, RBI compliance, various authorisations and all.

In some particular banks, scope of concurrent audit is very well defined to focus on the areas they are most concerned with. Now a days more and more branches are coming under the review of concurrent audit due to alarming rise of NPAs in all banks. So now banks are hiring more and more concurrent auditors to ensure their operational efficiency and profitability.

Audit of Stock & Commodities Brokers as prescribed under SEBI

- Half yearly auditof Brokers.

- Systems Audit.

- Concurrent and Internal Auditsof DPs.

- Financial Internal Audit.

- Management and Operations Audit.

- Branch & Sub-broker

- Auditof Portfolio Managers.

- Certification of income & performance.